massachusetts restaurant alcohol tax

1800 per 31-gallon barrel or 005 per 12-oz can. The Boston Massachusetts sales tax is 625.

Alcohol To Go Sales For Restaurants

The state charges driver under the age of 21.

. The penalty for driving with an open alcohol container anywhere except in the trunk is a fine of at least 100. Massachusetts restaurant alcohol tax Friday March 4 2022 Edit. Alcoholic Beverages other than Malt Beverages Wine and Vermouth containing 15 or less of Alcohol by volume at.

Therefore the total excise tax on spirits is 2630 per gallon. As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the Citys tax. Massachusetts restaurant alcohol tax Saturday May 14 2022 Edit.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. 107 - 340 per gallon or 021 - 067 per 750ml bottle. Due to a 2012 law change for sales made on and after July 1 2012 charges for alcoholic beverages are subject to tax at the 9 rate and charges for mandatory gratuities are subject to.

Depending on the type of business where youre doing business and other. Under 15 110gallon over 50 405proof gallon 057. Contact An Experienced Boston Tax Attorney.

The federal government collects approximately 1 billion per month from excise alcohol taxes on spirits beer and wine. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged. A Worcester County Massachusetts Alcohol Tax can only be obtained through an authorized government agency.

The tax is 625 of the sales price of. Home alcohol restaurant tax wallpaper. A 625 state sales tax is applied to all alcoholic beverages sold at retail.

Some area restaurant owners say legislation supported by 20 state senators and representatives that would eliminate the states 625 percent meals tax on food and alcohol for a week in. Liqour Taxes How High Are Distilled Spirits Taxes In Your State Bid. Federal excise tax rates on beer wine and liquor are as follows.

Chicago Restaurant Tax. Champagne and all other sparkling Wines. 625 of the sales price of the meal.

However it could be as high as 500. Whether you are facing an audit or want to safeguard your restaurant operations we have the experience to assist you. Taxes on spirits are significantly higher than beer and wine at 1350.

A 625 state sales tax is applied to all items except non-restaurant food and clothing under 175. As you can see to obtain an alcohol tax in Massachusetts Alcohol Tax you have to reach out to multiple agencies at various levels of government including federal state county and local.

Restaurants For Sale Bizbuysell Com

Another Massachusetts City Bans The Sale Of Nips

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

68 Banquet Hall Restaurant In Massachusetts Wedding Venues

How Much Does A Liquor License Cost

Savmor Spirits Savmorspirits Twitter

How Do State And Local Sales Taxes Work Tax Policy Center

Everything You Need To Know About Restaurant Taxes

How High Are Wine Taxes In Your State Tax Foundation

New York Sales Tax Basics For Restaurants Bars

How To Get Restaurant Licenses And Permits And What They Cost

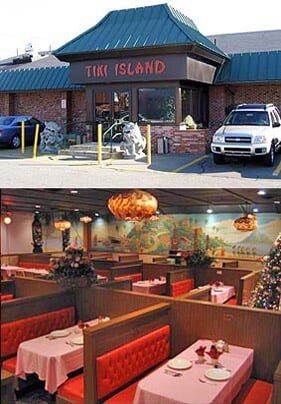

Lunch Menu Medford Ma Tiki Island Restaurant

Dining For A Cause Plymouth 400 Viscariello Hospitality Group Plymouth S Best Local Events Calendar Things To Do In Plymouth Massachusetts

Orange Beach Considering Liquor Tax Increasing License Fees Wpmi

Alcohol To Go Sales For Restaurants

Massachusetts Sales Tax Holiday Weekend Set For Aug 13 14 Cbs Boston

How To Get Restaurant Licenses And Permits And What They Cost