avalara tax codes mapping

Returns preparation filing and remittance for client. Buyout firm Vista Equity Partners agreed to acquire tax-management software provider Avalara Inc.

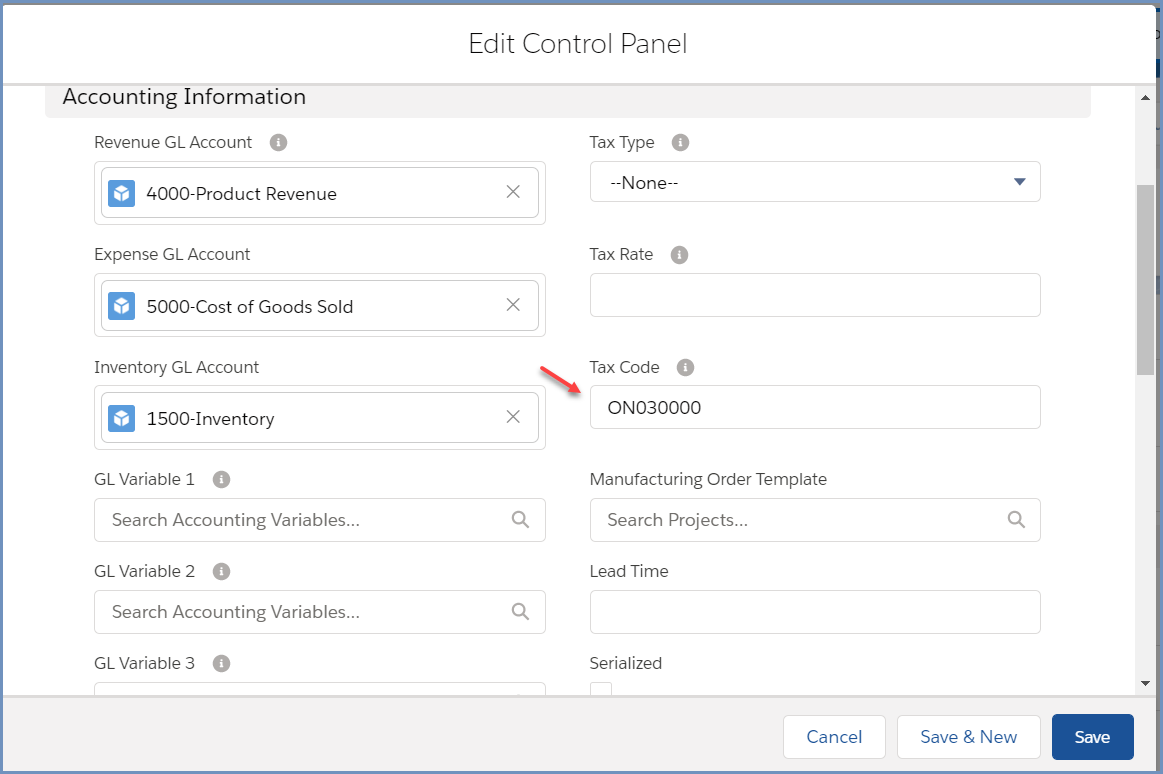

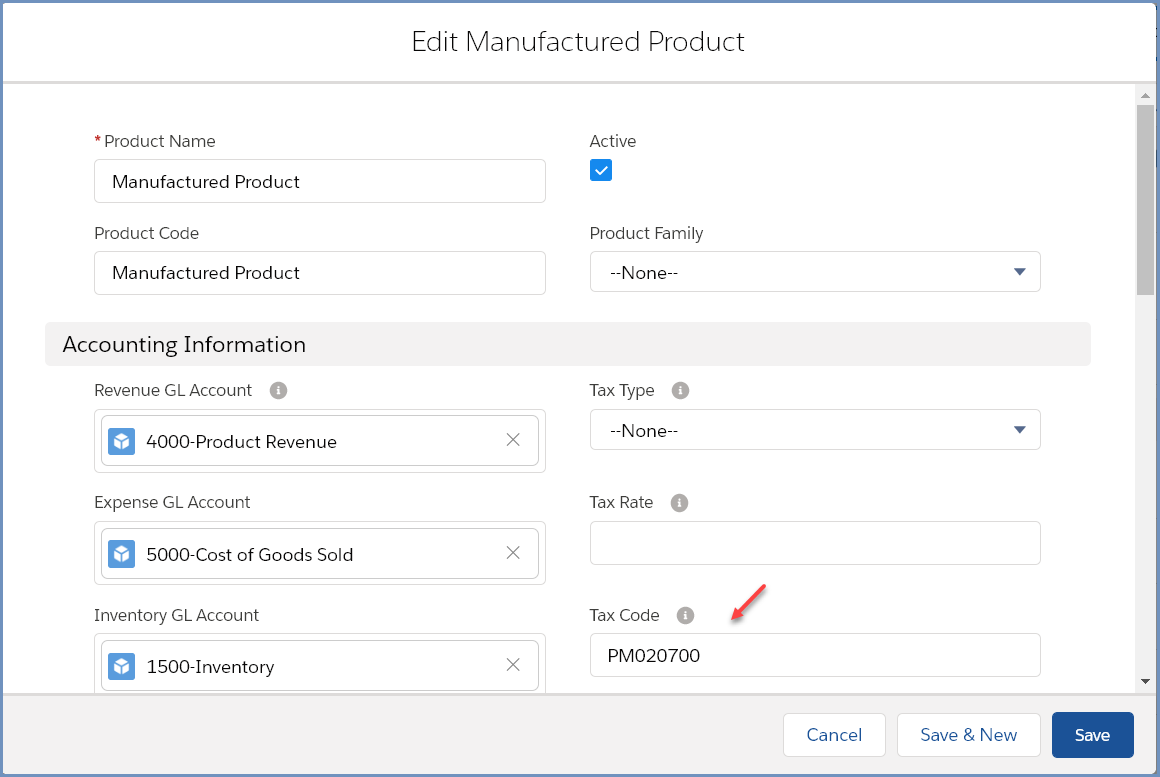

Set Up An Account Or A Product As Tax Exempt With Avatax Accounting Seed Knowledge Base

GL Entries - Tax Code is not a valid tax code name.

. Vista will purchase Seattle-based Avalara for 9350 per share in. Some customers prefer to go further - to actually create a product catalog and use AvaTaxs ItemCode feature to classify their products and link them with TaxCodes. Tax code mapping should be done within the active company in the Avalara AvaTax account as tax code mapping in Webgility does not import or transfer into Avalara AvaTax.

Again you should be using the list of Product Tax Codes that Avalara has predefined so that you are taking full advantage of their tax calculation engine. AvaTax tax code mapping - Item codeSKU. Retail ecommerce manufacturing software.

Avalara Managed Tariff Code Classification combines AI and human expertise to quickly assign consistent tariff codes for consumer products shipped to 180 countries. Sequence contains no matching element. AvaTax tax code mapping Avalara Developer.

In AvaTax go to Settings What You Sell. API solutions for end-to-end tax compliance. Download the Item Import toolkit and the Avalara tax code list.

Once you have added the Product Tax Codes that you will need to utilize for your items in Sage 500 ERP you can then assign each item to the proper Code using the task Maintain Item Tax Code Mapping Figure 2 below. Sales and use tax determination and exemption certificate management. To begin this process go to Integrations Taxes Avalara Tax Code Mapping.

Rapid sales tax results based on millions of pre-mapped Universal Product Codes UPC which includes specialized sales taxability data at the. In the User Defined Field 1 and User Defined Field 2 fields type any. Server audit clarity and installation.

In Sage 500 in the AvaTax folder under Maintenance click Maintain Item Tax Code Mapping and complete the following fields. AvaTax tax code mapping - Item codeSKU Avalara Developer. 53 - Mapping Items to TaxCodes.

This could be an Avalara tax code or a custom tax code. Sales and use tax. Using this feature its possible to build your connector or website without worrying about mapping products to TaxCodes at all.

Steps In AvaTax go to Settings What You Sell. On the What You Sell page select the checkboxes next to the items you want to map to the same Avalara tax code and then. Under Find and Select a Tax Code.

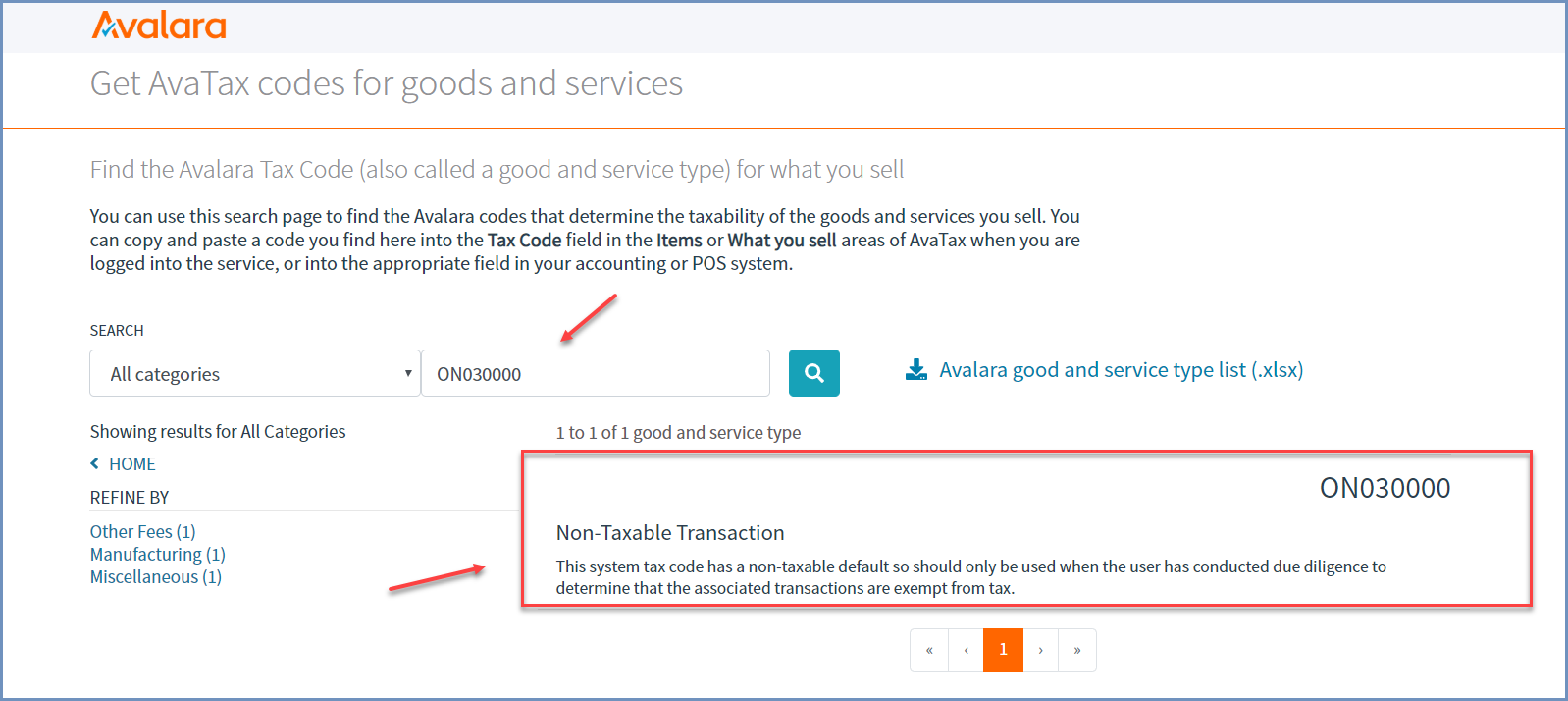

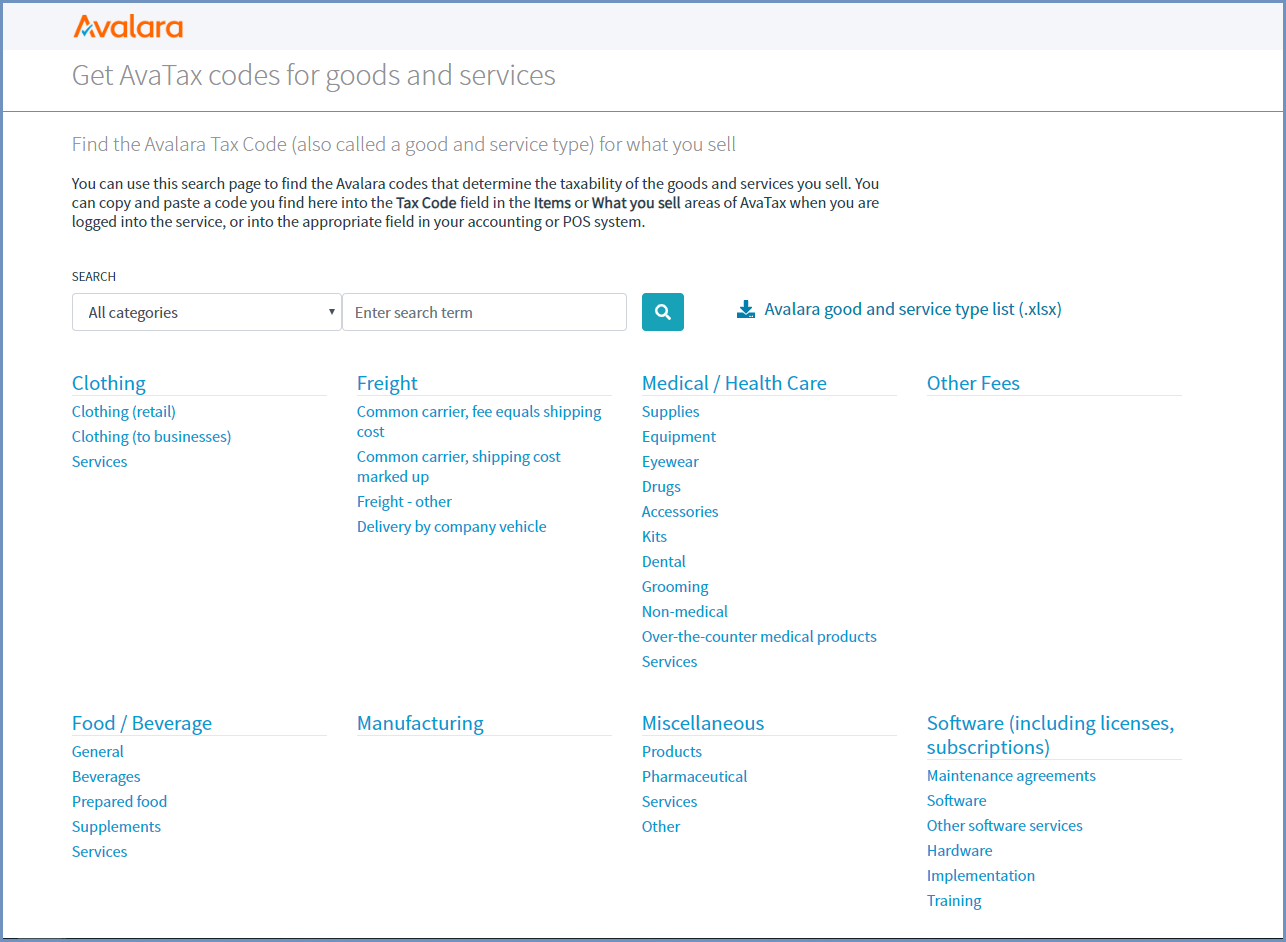

Failed to execute on status. Retail ecommerce manufacturing software. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell.

Send optional line-level data elements-Entity use code Latitudelongitude support Reasonable ratio of transaction and address validation calls to committed documents. Transaction and Service Types. Communications Enterprise Support Services.

Tax rates are incredibly difficult to. Sales and use tax. Sales and use tax determination and exemption certificate management.

Create the import file using the item and tax code import template guidelines. Failed to get contact bill contact for company Your Customer Name. Marketplace facilitator tax laws.

In the Item ID field select an item code. Tax management for VoiP IoT telecom cable. Short-term rental hotel BB tax management.

Tax management for VoiP IoT telecom cable. In the Tax Code ID field select a tax code. Avalara Self-Serve Tariff Code Classification is an intuitive AI-enabled tool that allows you to easily determine codes and requires no prior experience in HS classification.

P0000000 is a generic code that is used when you have items that arent mapped to an Avalara tax code. On the Import Items page in AvaTax drag and drop or upload your file. Short-term rental hotel BB tax management.

For 84 billion including debt. For each avatax company use the items option to map your items to tax codes. Common Transaction and Service type mapping scenarios in AvaTax for Communications.

Explaining the Non-Product ID. Send Avalara a list of items you sell so Avalara can map them to Harmonized System HS tariff codes. You can copy and paste a code you find here into the Tax Codes field in the Items or What you sell areas of AvaTax when you are logged into the service or into the appropriate field in your accounting or POS system.

API solutions for end-to-end tax compliance. If you have items that use P0000000 or U0000000 map them to an Avalara tax code so theyre taxed at the most up-to-date rate. Product Catalog Mapping Worksheet.

Marketplace facilitator tax laws. Returns preparation filing and remittance for client. Enter the Avalara tax code you want to assign to the items in the Tax Code field.

If you sell items such as clothing food software medical supplies software subscriptions and freight map them to Avalara tax codes to get the best sales tax rate for your. AFC Tax Changes - TS Pairs Tax Types and Rate Changes.

Set Up Avalara Avatax Integration Accounting Seed Knowledge Base

Understanding Freight Taxability Avalara Help Center

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Avalara Is Breaking Out To New Highs Nyse Avlr Seeking Alpha

Avalara Integration Fast Weigh

Sales Tax Research And Information Services Avalara

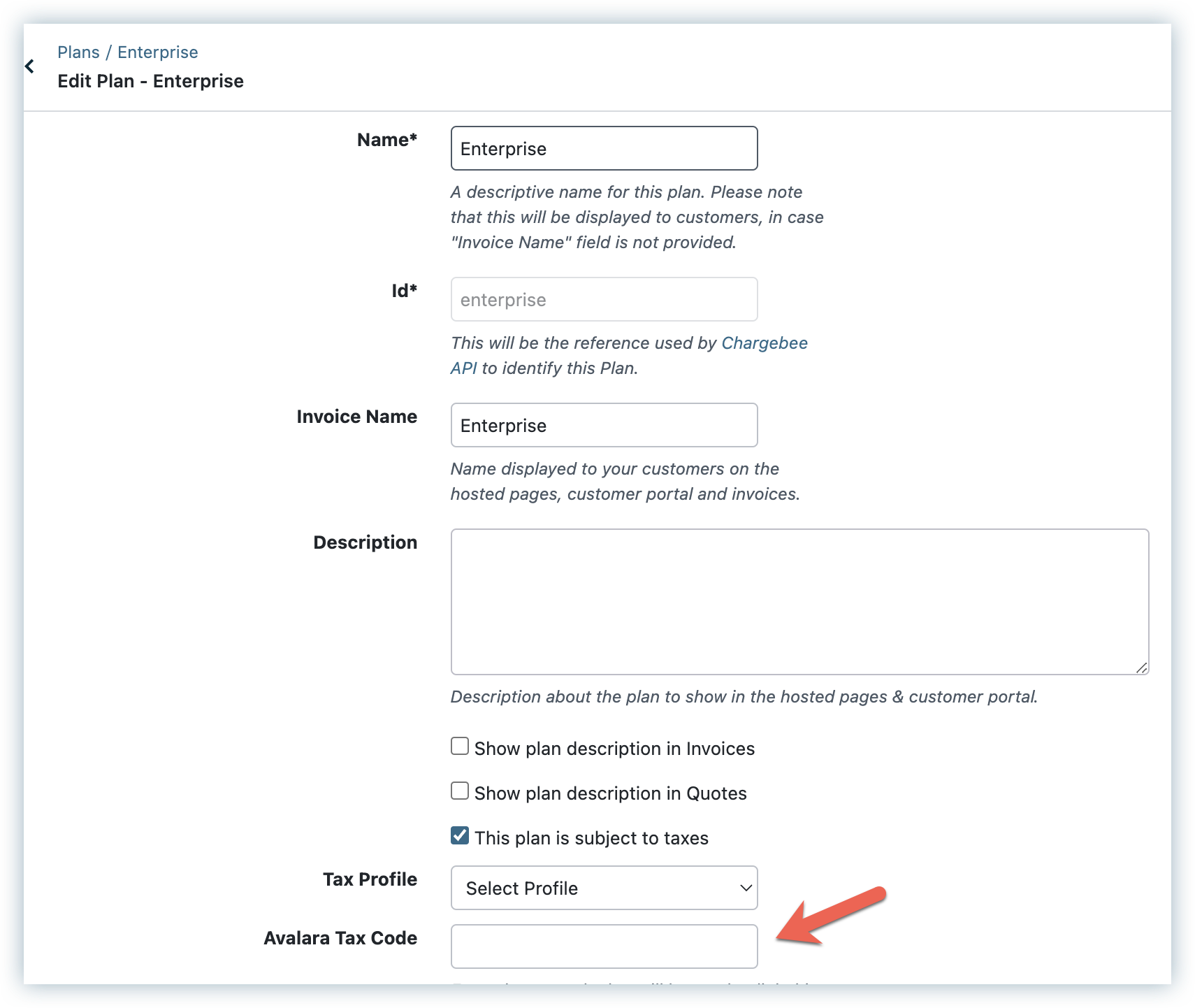

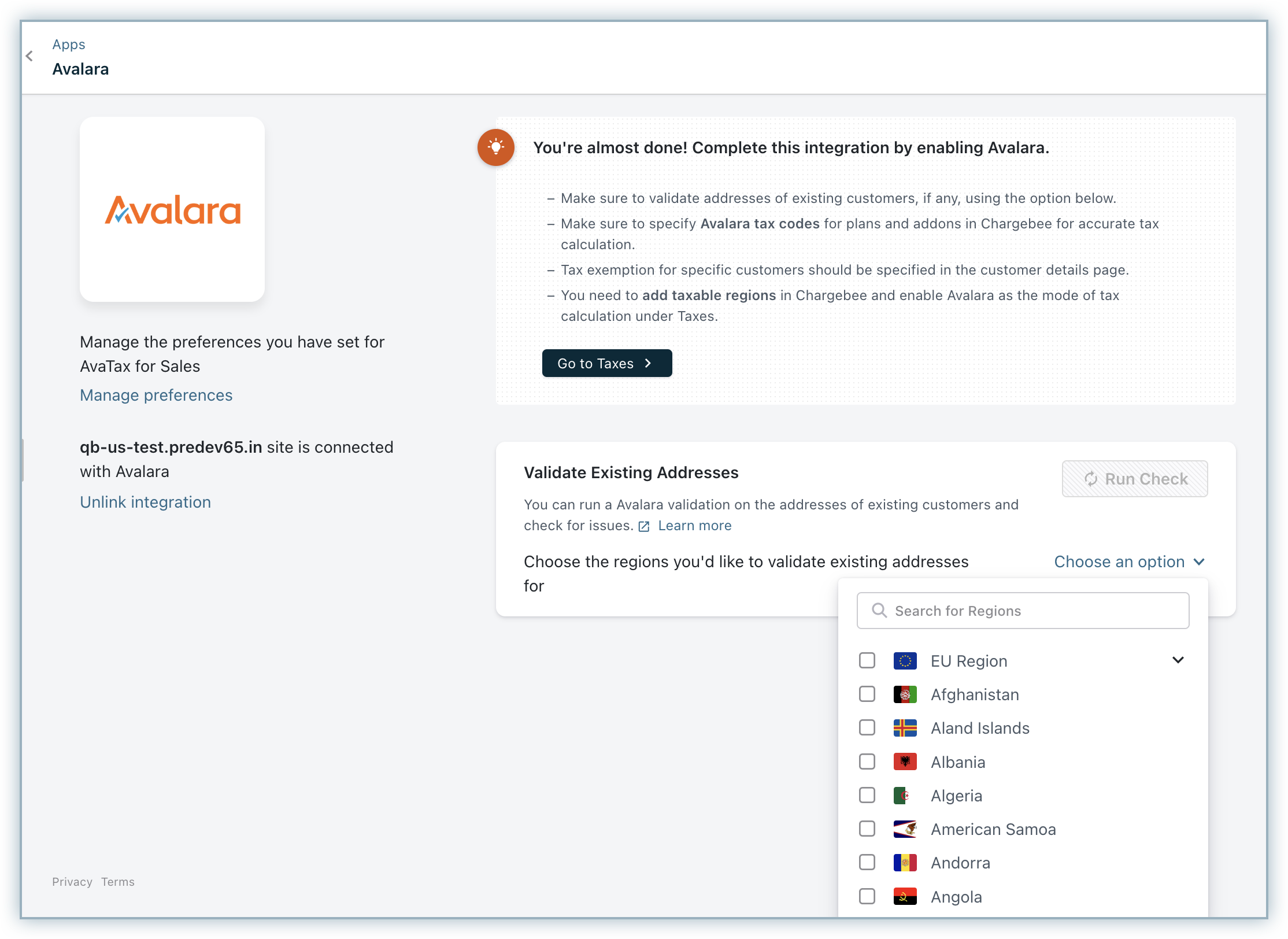

Avatax For Sales Chargebee Docs

Avalara Application By Kibo Ecommerce

Pin On Kitsap Innovation And Technology

Set Up An Account Or A Product As Tax Exempt With Avatax Accounting Seed Knowledge Base

Set Up Avalara Avatax Integration Accounting Seed Knowledge Base

Understanding The Avatax For Communications Tax Engine Avalara Help Center

Avatax For Sales Chargebee Docs